That doesn’t make too much sense what first direct told you.

Anyone can do a transaction to credit an account once they have the sort code/number & name, no one can stop that from happening.

Unless what they’re trying to say is that, they cannot access all your accounts again and that they were only granted access for that one session.

I don’t know the full details of how open banking is implemented, but I thought the idea was that access was granted on an ongoing basis. Potentially there could be an option to only allow access for the current session, but you’d think it would make that clear to the user, whereas in this case they specifically say by doing this you’re allowing access on a reoccurring basis.

For your own security, I’d look on your internet banking for where open banking is setup and check yourself that they’re not still granted access. I presume this must be available to configure on all banks internet banking, I’ve not used it myself.

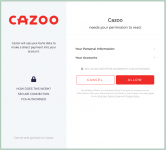

truelayer.com

truelayer.com