I totally agree can someone in control of this forum get this thread back on track thank you, Ho and a merry Christmas to you all.

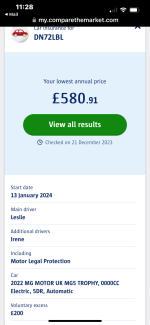

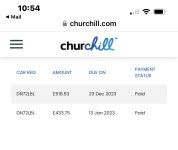

So here’s my insurance tale from this last week, last year I got my insurance for my MG5 Trophy facelift model via Compare the Market you know the meerkat one and I paid £433 for it with Churchill fully comp, myself and my wife as named drivers with legal assistance included, £200 compulsory excess and £200 voluntary excess so it is due again on the 13 January so i decided to see what it was going to cost this year, so 24 days before it is due I went on line to Compare the market and the best quote they give me was with the same company Churchill at £580

View attachment 22426

so I looked at a few others direct line £820 I think that was, LV £1900 yes £1900, both for the exact same cover anyhow two days later my renewal notice from Churchill dropped on the mat I open it up to find it’s for £648

View attachment 22425

but remember compare the market for exactly the same cover is £580 with the same company, so I decided to ring Churchill and ask why, didn’t really get an answer but the chap on the phone said can I run trough your details which we did at the end he came back with the figure of £518.53p needless to say I paid it right away.

View attachment 22424

So yeh you need to shop around a bit but when you have your renewal phone them up and check that’s the very best they can do.

So around £80 increase from last year I’m ok with that for todays rumoured insurance hikes don’t think I can do much better.

Les.