Never leased before but considering it for next time, in your experience is it better to try individual companies or use a site like leaselocoYes, I agree with him but as @Chrisdriving says above you need to find a good lease deal and do your own spreadsheet!!

I guess you could disagree if your intention is to keep the car well over the 3 years but then there are unknown MOT and repair costs etc.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Goodbye to my MG4, a cautionary tale

- Thread starter Tony60

- Start date

JonnyG

Prominent Member

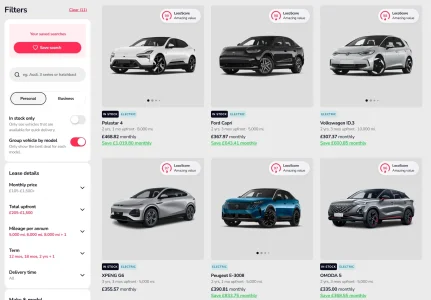

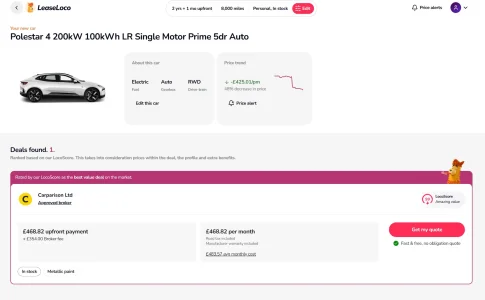

I find it best to use Leaseloco or Leasing.com initially as they are like comparison sites where you can filter and rank the best value deals.

Then if you find a car you like you can click on the “Find Deals” or similar tab and it will give you the broker name offering the deal.

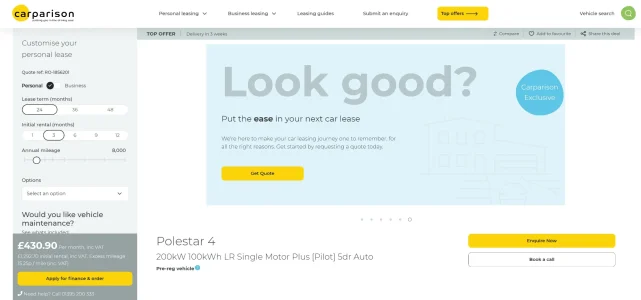

Then I go to the broker website and double check the deal is still there. It will also give more details and colour options etc…

See my inserts below. 1. My filtered search results (EV etc.) 2. The Deal Available. 3. The broker page with more details after Googling "Carparison".

If I was ordering now that's probably what I'd go for too !. Saw one on display in Meadowhall Shopping Centre and had a good look round and sit inside

They deliver to your house for free and pay all the VED. I stick to 2 year leases as you are a bit committed with a lease deal and I like to change car frequently!!! especially with EVs advancing so quickly

It’s hassle free motoring for two years and you can opt for a maintenance pack (servicing and tyres etc. if you want but I don’t bother for a 2 year lease.

It also doesn’t seem to affect your credit record as much as PCP as it’s not shown as a debt.

Then if you find a car you like you can click on the “Find Deals” or similar tab and it will give you the broker name offering the deal.

Then I go to the broker website and double check the deal is still there. It will also give more details and colour options etc…

See my inserts below. 1. My filtered search results (EV etc.) 2. The Deal Available. 3. The broker page with more details after Googling "Carparison".

If I was ordering now that's probably what I'd go for too !. Saw one on display in Meadowhall Shopping Centre and had a good look round and sit inside

They deliver to your house for free and pay all the VED. I stick to 2 year leases as you are a bit committed with a lease deal and I like to change car frequently!!! especially with EVs advancing so quickly

It’s hassle free motoring for two years and you can opt for a maintenance pack (servicing and tyres etc. if you want but I don’t bother for a 2 year lease.

It also doesn’t seem to affect your credit record as much as PCP as it’s not shown as a debt.

Attachments

Last edited:

Charlie the coach

Standard Member

- Joined

- Aug 17, 2021

- Messages

- 20

- Reaction score

- 24

- Points

- 13

- Location (town/city + country)

- Stepps, Glasgow

- Driving

- MG4 (2022-2025)

Hi Niki.A bit of unequal comparison this though. Business lease or salary sacrifice schemes will always be cheaper compared to PCP. (Till government changes the rules).

Private lease can be quite more expensive compared to PCP. Also any manufacturer contributions do not apply.

As for any negative equity I can't see the problem.

Hand the car back and walk away. Same with a lease.

The problem is that I would be paying £300 a month for a two year old MG4 for the next two years before handing it back.

Although taking out a 4 year PCP and changing my car every two years before, the high depreciation has now removed that option.

The price I've quoted is the lease price before the Government salary sacrifice schemes kicks in, therefore like for like. I am a sole trader business and therefore I am not even getting the large fleet discounts and it is still a better deal. Therefore my comment is useful to the many solopreneurs out there (this forum doesn't only cater for employees, unemployed and retired folks.)

Add to that the list price for the Enyaq I described is £49,500, which means my similar monthly outlay is getting me a new, superior, and better equipped car with brilliant reviews in all the EV columns.

Last edited:

Charlie the coach

Standard Member

- Joined

- Aug 17, 2021

- Messages

- 20

- Reaction score

- 24

- Points

- 13

- Location (town/city + country)

- Stepps, Glasgow

- Driving

- MG4 (2022-2025)

I agree JonnyI find it best to use Leaseloco or Leasing.com initially as they are like comparison sites where you can filter and rank the best value deals.

Then if you find a car you like you can click on the “Find Deals” or similar tab and it will give you the broker name offering the deal.

Then I go to the broker website and double check the deal is still there. It will also give more details and colour options etc…

See my inserts below. 1. My filtered search results (EV etc.) 2. The Deal Available. 3. The broker page with more details after Googling "Carparison".

If I was ordering now that's probably what I'd go for too !. Saw one on display in Meadowhall Shopping Centre and had a good look round and sit inside

They deliver to your house for free and pay all the VED. I stick to 2 year leases as you are a bit committed with a lease deal and I like to change car frequently!!! especially with EVs advancing so quickly

It’s hassle free motoring for two years and you can opt for a maintenance pack (servicing and tyres etc. if you want but I don’t bother for a 2 year lease.

It also doesn’t seem to affect your credit record as much as PCP as it’s not shown as a debt.

PCP worked well enough for me over the years when I could change my car every two years with a trade in contribution to my next car. With the massive depreciation we are seeing now, leasing is a much superior option.

JonnyG

Prominent Member

^^^^

Even more so now that EV’s are subject to VED tax. I know the MG4 is under the £40,000 luxury threshold but many EV’s aren’t and people forget that the lease company pay all the VED which would be over £400 a year alone for a PCP owner of that Polestar 4 I linked to above.

Even more so now that EV’s are subject to VED tax. I know the MG4 is under the £40,000 luxury threshold but many EV’s aren’t and people forget that the lease company pay all the VED which would be over £400 a year alone for a PCP owner of that Polestar 4 I linked to above.

domwild

Standard Member

- Joined

- Jul 5, 2024

- Messages

- 19

- Reaction score

- 6

- Points

- 4

- Location (town/city + country)

- Bentley (WA)

- Driving

- MG4 (2022-2025)

Fully agree! As they said in the Wild West: The pioneers catch all the arrows! MG4 51kWh Excite, April 2024 AU$40,000 from John Hughes, West Australia, minus $3,500 WA gov. rebate. Two months later price dropped to $31,000, perhaps 2023 model? My warranty was 7 years, then it went up to 10 years adding insult to the lower price injury!So, coming up to two years after buying my MG4 long range, registered November 2023, bought from Arnold Clark on PCP 0% finance. Overall I've been happy with the car, nice to drive and decent range, there have been a few niggles though. The original app was very flakey and inconsistent, although the recent replacement app works a bit better for charging. The tyre pressure warning light is a nuisance, always coming on when the car is cold which has me constantly checking the pressure. The infotainment screen is inconsistent especially using Android Auto and the DAB radio signal is awful. As I say, I've been generally happy with the car's overall drive and performance, the niggles are easy to live with.

My biggest disappointment is learning that the settlement figure after 25 months is around £2400 more than the car is now worth, despite it only having 8,300 miles on the clock and me putting in over £8000 deposit. I probably would have considered keeping hold of the car but I don't really want to pay £15,900 settlement for a car that's only worth £13,500. Lesson learnt is don't buy brand new electric cars at the moment as the depreciation is way too high. I've just sourced a Ford Explorer Long range, registered Aug 2024 with 230 miles on the clock, it has £2000 worth of driver assist extras on and would normally retail for around £47K. Cost to me is £29K for what is almost a brand new car, driven as a demonstrator. Still will be quite sad to see my little MG4 been driven away by the finance company next month.

Now John Hughes will no longer advertise the price for the 2025 model, but competitor is asking $38,000, no more WA gov. discount. So MG has upped the price as too many complained about the drop in price of brand new MGs. There is strong competition from BYD with its Dolpins, Attos, etc.

Battery prices will drop year-by-year and performance will increase, so drive your ICE bomb as long as possible as ICE/EV parity is around the corner.

NikLiverpool

Prominent Member

Hi Niki.

The problem is that I would be paying £300 a month for a two year old MG4 for the next two years before handing it back.

Although taking out a 4 year PCP and changing my car every two years before, the high depreciation has now removed that option.

The price I've quoted is the lease price before the Government salary sacrifice schemes kicks in, therefore like for like. I am a sole trader business and therefore I am not even getting the large fleet discounts and it is still a better deal. Therefore my comment is useful to the many solopreneurs out there (this forum doesn't only cater for employees, unemployed and retired folks.)

Add to that the list price for the Enyaq I described is £49,500, which means my similar monthly outlay is getting me a new, superior, and better equipped car with brilliant reviews in all the EV columns.

Apologies if I gave any wrong impressions. It was not my intention to sound aggressive or anything.

I just wanted to point out that lease can indeed be a viable option but it is not always the cheapest option out there unless you do not really mind what car you get and therefore you are open to take the best deal. Under these circumstances yes; it does make sense.

Personally I am happy to pay a bit more if that gives me the opportunity to drive the car I really want to.

In my case per se; I placed an order for an IM6 launch. I scoured the internet for a lease that would be either cheaper or at least on par with the PCP deal (which includes the MG and a carwow discount).

I couldn't find anything...Best quote I found as a private deal was 5k more expensive on a 4 year deal. Even on a 2 or a 3 year it was still more expensive for this car.

I took under consideration services, luxury tax, everything. I just could not justify the lease.

Were there any cheaper cars that could fit the bill (luxury-ish EV suv)? You bet there were. Problem is; I just don't fancy them....

I want to like what I drive. If this was just being sensible I would just go for a Jaecoo 7 and be happy with it.

Chrisdriving

Prominent Member

- Joined

- Jun 12, 2024

- Messages

- 730

- Reaction score

- 1,523

- Points

- 382

- Location (town/city + country)

- dorset

- Driving

- MG4 (2022-2025)

Some good IM6 deals for sure .

Seen a PCP 3k down £416 a month launch edition 0% apr. Pre reg.

No lease to touch that right now.

Seen a PCP 3k down £416 a month launch edition 0% apr. Pre reg.

No lease to touch that right now.

Charlie the coach

Standard Member

- Joined

- Aug 17, 2021

- Messages

- 20

- Reaction score

- 24

- Points

- 13

- Location (town/city + country)

- Stepps, Glasgow

- Driving

- MG4 (2022-2025)

I know you don't want to sound aggressive Nik, however you are misinformed.Apologies if I gave any wrong impressions. It was not my intention to sound aggressive or anything.

I just wanted to point out that lease can indeed be a viable option but it is not always the cheapest option out there unless you do not really mind what car you get and therefore you are open to take the best deal. Under these circumstances yes; it does make sense.

Personally I am happy to pay a bit more if that gives me the opportunity to drive the car I really want to.

In my case per se; I placed an order for an IM6 launch. I scoured the internet for a lease that would be either cheaper or at least on par with the PCP deal (which includes the MG and a carwow discount).

I couldn't find anything...Best quote I found as a private deal was 5k more expensive on a 4 year deal. Even on a 2 or a 3 year it was still more expensive for this car.

I took under consideration services, luxury tax, everything. I just could not justify the lease.

Were there any cheaper cars that could fit the bill (luxury-ish EV suv)? You bet there were. Problem is; I just don't fancy them....

I want to like what I drive. If this was just being sensible I would just go for a Jaecoo 7 and be happy with it.

I took time to choose the car I really wanted, and after watching numerous videos, reading Which Car reports , and going out and test driving vehicles, I personally chose the car I wanted then contacted the leasing company. They searched the market and got me the car at an excellent price and I no longer have to bother with negative equity, I just hand the car back at the end of contract and the leasing company takes care of that.

I loved this forum because it is full of people who really know what they are talking about and give solid useful advice. You may mean well but you are expressing your opinions and not checking the facts before expressing them.

NikLiverpool

Prominent Member

Fair enough and I am glad that you managed to find the car you were after through a good deal.

Regarding the negative equity though, please explain to me why will I be affected with it?

At the end of my deal if indeed the car has negative equity Vs the GFV why would this be my problem?

I will just hand back the keys and walk away.

As for me expressing my personal opinion well that's what we all do here based on our circumstances and desires.

In your case the lease worked well and it will do so for many other people.

In my case as for others it didn't.

Why is this me missinforming?

Regarding the negative equity though, please explain to me why will I be affected with it?

At the end of my deal if indeed the car has negative equity Vs the GFV why would this be my problem?

I will just hand back the keys and walk away.

As for me expressing my personal opinion well that's what we all do here based on our circumstances and desires.

In your case the lease worked well and it will do so for many other people.

In my case as for others it didn't.

Why is this me missinforming?

Joningy

Established Member

I have exactly the same problem, but with me the diffrence is £3,600 out of pocket, the difference between the required final (baloon) paymennt and the car value, so the car is being returned to the finance company in a week or two .So, coming up to two years after buying my MG4 long range, registered November 2023, bought from Arnold Clark on PCP 0% finance. Overall I've been happy with the car, nice to drive and decent range, there have been a few niggles though. The original app was very flakey and inconsistent, although the recent replacement app works a bit better for charging. The tyre pressure warning light is a nuisance, always coming on when the car is cold which has me constantly checking the pressure. The infotainment screen is inconsistent especially using Android Auto and the DAB radio signal is awful. As I say, I've been generally happy with the car's overall drive and performance, the niggles are easy to live with.

My biggest disappointment is learning that the settlement figure after 25 months is around £2400 more than the car is now worth, despite it only having 8,300 miles on the clock and me putting in over £8000 deposit. I probably would have considered keeping hold of the car but I don't really want to pay £15,900 settlement for a car that's only worth £13,500. Lesson learnt is don't buy brand new electric cars at the moment as the depreciation is way too high. I've just sourced a Ford Explorer Long range, registered Aug 2024 with 230 miles on the clock, it has £2000 worth of driver assist extras on and would normally retail for around £47K. Cost to me is £29K for what is almost a brand new car, driven as a demonstrator. Still will be quite sad to see my little MG4 been driven away by the finance company next month.

But I've stayed with MG, got a fabulous deal on a new MGS5 Trophy, nearly £10,000 of list price, but had to stump up cash, so my depreciation is already virtually taken care of (hopefully)

I wont go down the route of interest free PCP finance again, it's a big con because you normally buy the car at full retail price and finance companies don't loose out much, considering MG can give nearly 30% discount, they all share the bounty.

One thing we can guarantee with buying a brand new EV is it will lose a good whack of cashFair enough and I am glad that you managed to find the car you were after through a good deal.

Regarding the negative equity though, please explain to me why will I be affected with it?

At the end of my deal if indeed the car has negative equity Vs the GFV why would this be my problem?

I will just hand back the keys and walk away.

As for me expressing my personal opinion well that's what we all do here based on our circumstances and desires.

In your case the lease worked well and it will do so for many other people.

In my case as for others it didn't.

Why is this me missinforming?

Depending on how much you put down as a deposit on PCP you can also probably guarantee you will lose most if not all of that also.

Yes you can hand it back if it ends up in negative equity at the end of the deal but if that is the plan then a lease deal normally involves less money upfront less money every month and the same outcome at the end.

Negative equity can obviously be offset with a big discount but only to a point, you only have to look on auto trader to see how much money EVs are losing

- Joined

- Jun 13, 2022

- Messages

- 8,051

- Reaction score

- 13,089

- Points

- 3,598

- Location (town/city + country)

- Paignton, UK

- Driving

- MG4 (2022-2025)

Wise words. It's important to factor everything in and look at the amount if interest you are being charged.

Low rate often means little or no discount.

Big discount can mean higher interest rates.

Big deposit means lower payments but how much per month is that deposit worth?

Lower mileage saves money but what is the penalty rate if you go over?

How easy is it to cancel early if your circumstances change?

Low rate often means little or no discount.

Big discount can mean higher interest rates.

Big deposit means lower payments but how much per month is that deposit worth?

Lower mileage saves money but what is the penalty rate if you go over?

How easy is it to cancel early if your circumstances change?

Spot on MG Affinity is a perfect case in point.Wise words. It's important to factor everything in and look at the amount if interest you are being charged.

Low rate often means little or no discount.

Big discount can mean higher interest rates.

Big deposit means lower payments but how much per month is that deposit worth?

Lower mileage saves money but what is the penalty rate if you go over?

How easy is it to cancel early if your circumstances change?

Normal MG finance apr 0% deals or 2.9% with less of a deposit (both really good deals)

Use MG Affinity and it's 6.9% the affinity discount still makes it worthwhile similar scenario with pre reg cars

Joningy

Established Member

Very likely leasing is the best option for most people, but the fabulous deals on the MGS5 of near £10,000 discount takes care of an awful lot of the depreciation on my car compared to a PCP plan at full retail. But I've seen even better deals on Auto trader than I got, I thought it was a great deal, but I've seen several MGS5 Trophys in the past week saving several hundred pounds on the deal got!One thing we can guarantee with buying a brand new EV is it will lose a good whack of cash

Depending on how much you put down as a deposit on PCP you can also probably guarantee you will lose most if not all of that also.

Yes you can hand it back if it ends up in negative equity at the end of the deal but if that is the plan then a lease deal normally involves less money upfront less money every month and the same outcome at the end.

Negative equity can obviously be offset with a big discount but only to a point, you only have to look on auto trader to see how much money EVs are losing

That's car salesmen for ya, they tell porkies to reach their targets, I class them with estate agents, they aren't all good tarred with the same brush, but I'm sure now, had I waited until September I'd have got a still better deal.

But I'm happy with the S5, apart from a few unnecessary niggles.

Cabansail

Established Member

- Joined

- Aug 26, 2025

- Messages

- 226

- Reaction score

- 367

- Points

- 110

- Location (town/city + country)

- Lismore NSW Australia

- Driving

- MG4 (2022-2025)

Lots of incentives here in Australia to lease EV's but none of them were any good for me.

Just bought one used, 22 months old and 28,000 km on the dial.

Just bought one used, 22 months old and 28,000 km on the dial.

N80SSM

Established Member

- Joined

- Aug 3, 2024

- Messages

- 76

- Reaction score

- 94

- Points

- 28

- Location (town/city + country)

- Dundee

- Driving

- MG4 (2022-2025)

I will likely voluntarily terminate my pcp deal once I've hit the 50% point and lease. Long gone are the days when you had equity at year 3 of a 4 year pcp deal. Don't fancy keeping the mg4 for 4 years, even 2 years will be enough.

Cabansail

Established Member

- Joined

- Aug 26, 2025

- Messages

- 226

- Reaction score

- 367

- Points

- 110

- Location (town/city + country)

- Lismore NSW Australia

- Driving

- MG4 (2022-2025)

Don't like it?

N80SSM

Established Member

- Joined

- Aug 3, 2024

- Messages

- 76

- Reaction score

- 94

- Points

- 28

- Location (town/city + country)

- Dundee

- Driving

- MG4 (2022-2025)

Just get bored of cars quick, I traded my year old 4 series for the mg4 and still haven't accepted itDon't like it?

Joningy

Established Member

My MG4 goes back anytime from next week when the final payment goes out to the finance company, I already have an S5 Trophy, paid cash, got a brilliant deal.I will likely voluntarily terminate my pcp deal once I've hit the 50% point and lease. Long gone are the days when you had equity at year 3 of a 4 year pcp deal. Don't fancy keeping the mg4 for 4 years, even 2 years will be enough.

No more 0% finance deals, nothing like they used to be.

Similar threads

- Replies

- 15

- Views

- 3K